Vodafone Idea (Vi), India’s third-largest telecom operator, is facing a number of challenges, including the lack of 5G service and a shortage of fresh funds. This could further hurt the company’s prospects, especially as its rivals Bharti Airtel and Reliance Jio are rapidly expanding their 5G networks and gaining market share.

Impact of lack of 5G service

5G is the next generation of wireless technology that offers faster speeds, lower latency, and greater capacity than 4G. It is expected to revolutionize the way people use their smartphones and other devices, enabling new applications such as augmented reality, virtual reality, and self-driving cars.

Airtel and Jio have already launched 5G services in several cities across India, and they are rapidly expanding their networks. Vi, on the other hand, has yet to launch 5G services. This is a major disadvantage for the company, as it could lead to customers churning to its rivals in order to get access to 5G.

Impact of shortage of fresh funds

Vi is also facing a shortage of fresh funds. The company has been struggling to generate revenue and profits, and it has a large debt burden. This makes it difficult for Vi to invest in new technologies and services, such as 5G.

In contrast, Airtel and Jio have strong financial positions. This gives them the ability to invest heavily in 5G and other new technologies.

Impact on Vodafone Idea’s business

The lack of 5G service and the shortage of fresh funds could have a significant impact on Vodafone Idea’s business. The company could lose market share to its rivals, and it could become difficult for it to compete in the long term.

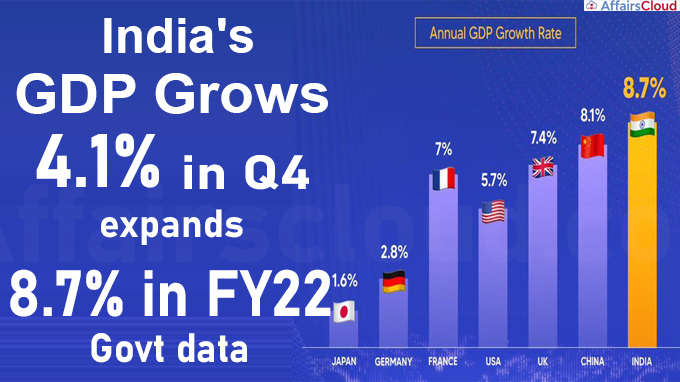

Vodafone Idea has already been losing market share to Airtel and Jio in recent years. In the first quarter of 2023, Vodafone Idea’s market share was 22.9%, down from 23.2% in the previous quarter. Airtel’s market share was 35.8%, up from 35.6% in the previous quarter. Jio’s market share was 41.3%, up from 41.2% in the previous quarter.

If Vodafone Idea is unable to launch 5G services soon, it is likely to lose even more market share to its rivals. This could lead to a decline in revenue and profits, and it could make it even more difficult for the company to raise fresh funds.

Conclusion

Vodafone Idea is facing a number of challenges that could further hurt its prospects in the Indian telecom market. The company needs to address these challenges in order to remain competitive in the long term.

Additional thoughts

One way that Vodafone Idea could address its challenges is to merge with another telecom operator. This would give the company more resources to invest in 5G and other new technologies. However, it is unclear whether Vodafone Idea is open to a merger.

Another option for Vodafone Idea is to sell its assets to another telecom operator. This would give the company the funds to pay off its debt and invest in new technologies. However, it is unclear whether Vodafone Idea is willing to sell its assets.

Ultimately, the future of Vodafone Idea depends on how the company addresses its current challenges. If the company is unable to launch 5G services soon and raise fresh funds, it could be forced to exit the Indian telecom market.